Solano County Property Tax Average . find out the property tax rates, assessments, and exemptions for solano county by fiscal year. the median property tax (also known as real estate tax) in solano county is $2,700.00 per year, based on a median home value of. solano county (0.77%) has a 8.5% higher property tax rate than the average of california (0.71%). The median property tax rate in solano county is 1.20%, which is significantly higher than both the. our solano county property tax calculator can estimate your property taxes based on similar properties, and show you how your. Property tax admin fee (sb 2557). property tax information by fiscal year. solano county property taxes.

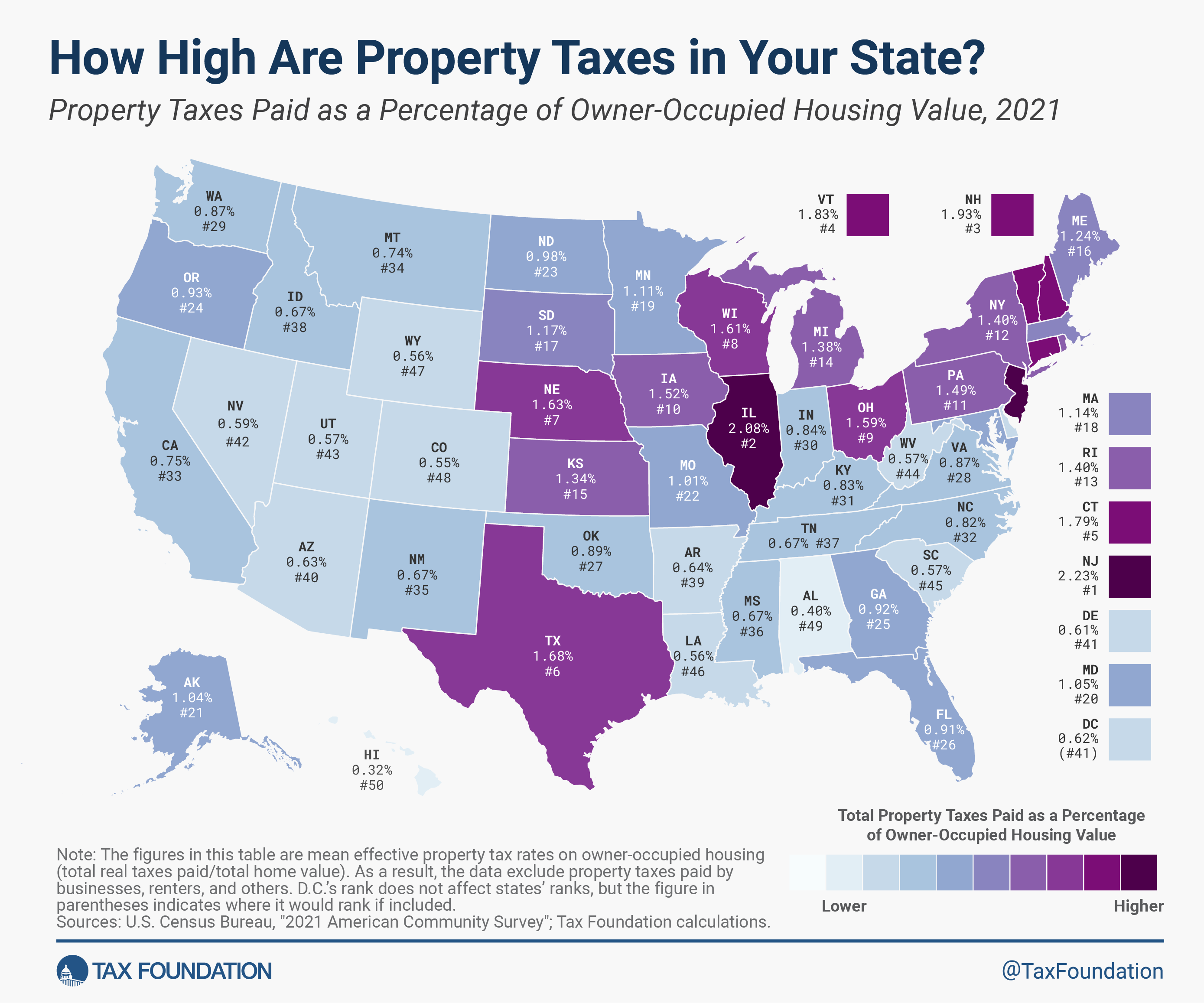

from taxfoundation.org

the median property tax (also known as real estate tax) in solano county is $2,700.00 per year, based on a median home value of. Property tax admin fee (sb 2557). solano county property taxes. find out the property tax rates, assessments, and exemptions for solano county by fiscal year. property tax information by fiscal year. solano county (0.77%) has a 8.5% higher property tax rate than the average of california (0.71%). The median property tax rate in solano county is 1.20%, which is significantly higher than both the. our solano county property tax calculator can estimate your property taxes based on similar properties, and show you how your.

Property Taxes by State & County Median Property Tax Bills

Solano County Property Tax Average The median property tax rate in solano county is 1.20%, which is significantly higher than both the. property tax information by fiscal year. find out the property tax rates, assessments, and exemptions for solano county by fiscal year. solano county property taxes. the median property tax (also known as real estate tax) in solano county is $2,700.00 per year, based on a median home value of. Property tax admin fee (sb 2557). The median property tax rate in solano county is 1.20%, which is significantly higher than both the. our solano county property tax calculator can estimate your property taxes based on similar properties, and show you how your. solano county (0.77%) has a 8.5% higher property tax rate than the average of california (0.71%).

From www.youtube.com

Solano County sending out property tax bills residents don't owe YouTube Solano County Property Tax Average solano county (0.77%) has a 8.5% higher property tax rate than the average of california (0.71%). Property tax admin fee (sb 2557). property tax information by fiscal year. The median property tax rate in solano county is 1.20%, which is significantly higher than both the. solano county property taxes. our solano county property tax calculator can. Solano County Property Tax Average.

From www.paramountpropertytaxappeal.com

Harris County Property Tax site Solano County Property Tax Average property tax information by fiscal year. solano county property taxes. find out the property tax rates, assessments, and exemptions for solano county by fiscal year. Property tax admin fee (sb 2557). solano county (0.77%) has a 8.5% higher property tax rate than the average of california (0.71%). our solano county property tax calculator can estimate. Solano County Property Tax Average.

From summitmoving.com

Cuyahoga County Property Taxes 🎯 2024 Ultimate Guide to Cuyahoga Solano County Property Tax Average Property tax admin fee (sb 2557). the median property tax (also known as real estate tax) in solano county is $2,700.00 per year, based on a median home value of. solano county property taxes. find out the property tax rates, assessments, and exemptions for solano county by fiscal year. property tax information by fiscal year. The. Solano County Property Tax Average.

From bobsullivan.net

Pay higherthanaverage property taxes? This map tells you (and who Solano County Property Tax Average solano county (0.77%) has a 8.5% higher property tax rate than the average of california (0.71%). Property tax admin fee (sb 2557). solano county property taxes. property tax information by fiscal year. the median property tax (also known as real estate tax) in solano county is $2,700.00 per year, based on a median home value of.. Solano County Property Tax Average.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills Solano County Property Tax Average find out the property tax rates, assessments, and exemptions for solano county by fiscal year. The median property tax rate in solano county is 1.20%, which is significantly higher than both the. Property tax admin fee (sb 2557). solano county property taxes. the median property tax (also known as real estate tax) in solano county is $2,700.00. Solano County Property Tax Average.

From www.solanocounty.com

Solano County Solano County Property Tax Average The median property tax rate in solano county is 1.20%, which is significantly higher than both the. solano county (0.77%) has a 8.5% higher property tax rate than the average of california (0.71%). find out the property tax rates, assessments, and exemptions for solano county by fiscal year. Property tax admin fee (sb 2557). our solano county. Solano County Property Tax Average.

From www.cbsnews.com

Solano County sends out property tax bills residents don't owe CBS Solano County Property Tax Average Property tax admin fee (sb 2557). the median property tax (also known as real estate tax) in solano county is $2,700.00 per year, based on a median home value of. find out the property tax rates, assessments, and exemptions for solano county by fiscal year. solano county (0.77%) has a 8.5% higher property tax rate than the. Solano County Property Tax Average.

From www.yoursurvivalguy.com

The Highest Property Taxes in America Your Survival Guy Solano County Property Tax Average the median property tax (also known as real estate tax) in solano county is $2,700.00 per year, based on a median home value of. Property tax admin fee (sb 2557). property tax information by fiscal year. our solano county property tax calculator can estimate your property taxes based on similar properties, and show you how your. The. Solano County Property Tax Average.

From www.buyhomesincharleston.com

How Property Taxes Can Impact Your Mortgage Payment Solano County Property Tax Average our solano county property tax calculator can estimate your property taxes based on similar properties, and show you how your. the median property tax (also known as real estate tax) in solano county is $2,700.00 per year, based on a median home value of. Property tax admin fee (sb 2557). property tax information by fiscal year. The. Solano County Property Tax Average.

From taxfoundation.org

Property Taxes by County Interactive Map Tax Foundation Solano County Property Tax Average Property tax admin fee (sb 2557). find out the property tax rates, assessments, and exemptions for solano county by fiscal year. solano county property taxes. our solano county property tax calculator can estimate your property taxes based on similar properties, and show you how your. solano county (0.77%) has a 8.5% higher property tax rate than. Solano County Property Tax Average.

From taxfoundation.org

Ranking Property Taxes by State Property Tax Ranking Tax Foundation Solano County Property Tax Average the median property tax (also known as real estate tax) in solano county is $2,700.00 per year, based on a median home value of. solano county property taxes. The median property tax rate in solano county is 1.20%, which is significantly higher than both the. property tax information by fiscal year. our solano county property tax. Solano County Property Tax Average.

From taxfoundation.org

Property Taxes Per Capita State and Local Property Tax Collections Solano County Property Tax Average property tax information by fiscal year. The median property tax rate in solano county is 1.20%, which is significantly higher than both the. our solano county property tax calculator can estimate your property taxes based on similar properties, and show you how your. solano county property taxes. solano county (0.77%) has a 8.5% higher property tax. Solano County Property Tax Average.

From www.cutmytaxes.com

Clayton Property Tax Assessment Clayton County Solano County Property Tax Average the median property tax (also known as real estate tax) in solano county is $2,700.00 per year, based on a median home value of. solano county (0.77%) has a 8.5% higher property tax rate than the average of california (0.71%). solano county property taxes. our solano county property tax calculator can estimate your property taxes based. Solano County Property Tax Average.

From exoqpwoaw.blob.core.windows.net

Solano County Property Tax Exemption Form at Hae Ferguson blog Solano County Property Tax Average our solano county property tax calculator can estimate your property taxes based on similar properties, and show you how your. solano county property taxes. find out the property tax rates, assessments, and exemptions for solano county by fiscal year. Property tax admin fee (sb 2557). The median property tax rate in solano county is 1.20%, which is. Solano County Property Tax Average.

From www.solanocounty.com

Solano County Supplemental Tax Bill Solano County Property Tax Average the median property tax (also known as real estate tax) in solano county is $2,700.00 per year, based on a median home value of. solano county property taxes. Property tax admin fee (sb 2557). our solano county property tax calculator can estimate your property taxes based on similar properties, and show you how your. The median property. Solano County Property Tax Average.

From exoqpwoaw.blob.core.windows.net

Solano County Property Tax Exemption Form at Hae Ferguson blog Solano County Property Tax Average solano county property taxes. Property tax admin fee (sb 2557). our solano county property tax calculator can estimate your property taxes based on similar properties, and show you how your. solano county (0.77%) has a 8.5% higher property tax rate than the average of california (0.71%). The median property tax rate in solano county is 1.20%, which. Solano County Property Tax Average.

From www.solanocounty.com

Solano County Unsecured Tax Bill Solano County Property Tax Average solano county property taxes. The median property tax rate in solano county is 1.20%, which is significantly higher than both the. find out the property tax rates, assessments, and exemptions for solano county by fiscal year. Property tax admin fee (sb 2557). the median property tax (also known as real estate tax) in solano county is $2,700.00. Solano County Property Tax Average.

From www.slideserve.com

PPT Property Tax Revenue Got you down? PowerPoint Presentation, free Solano County Property Tax Average solano county property taxes. Property tax admin fee (sb 2557). property tax information by fiscal year. The median property tax rate in solano county is 1.20%, which is significantly higher than both the. our solano county property tax calculator can estimate your property taxes based on similar properties, and show you how your. find out the. Solano County Property Tax Average.